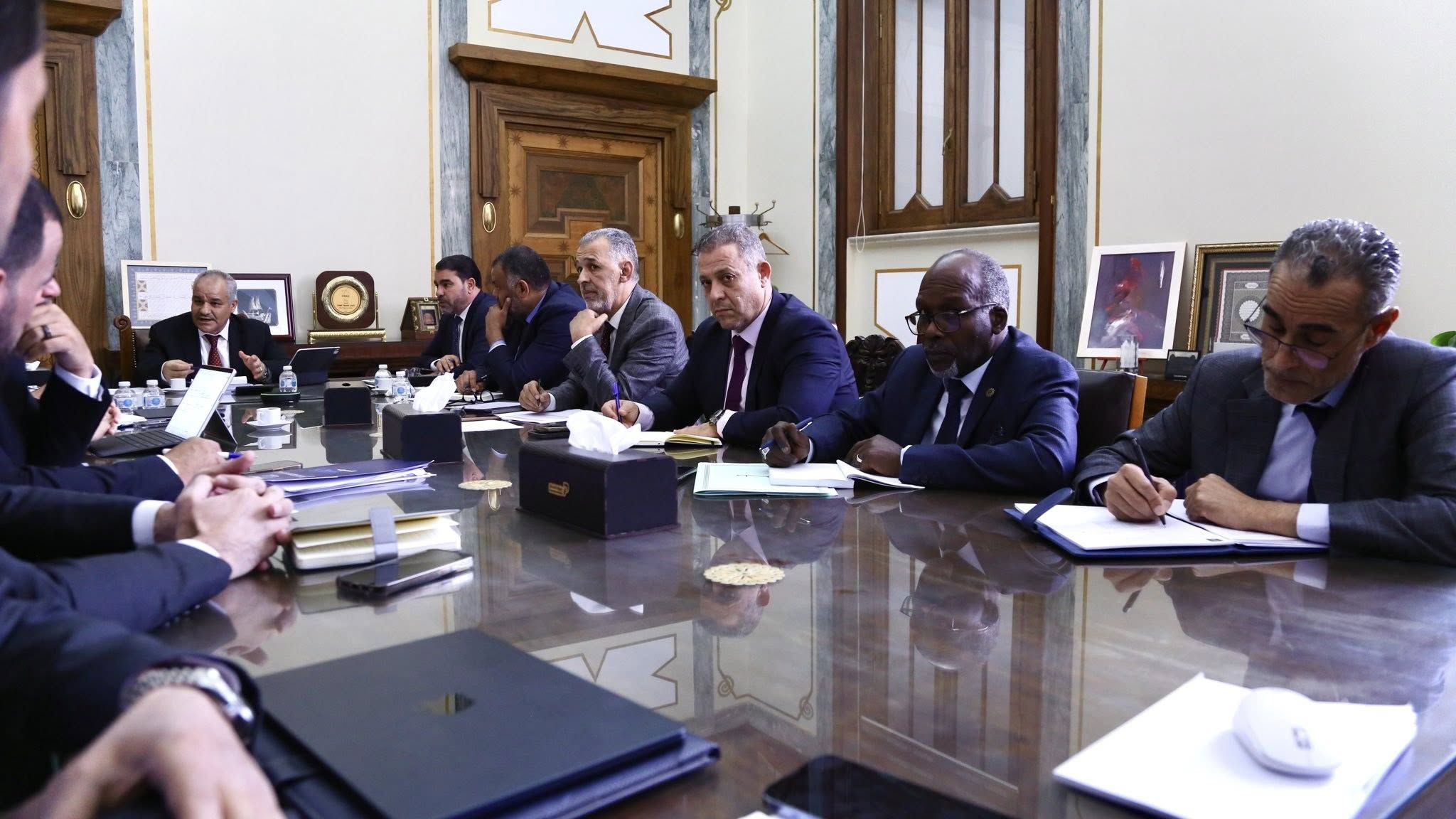

Governor of the Central Bank of Libya and his Deputy meet with the General Managers of Commercial Banks

H.E. Mr. Naji Mohammed Issa, Governor of the Central Bank of Libya ,and his Deputy, held an extensive meeting, with the General Managers of major commercial banks, representatives from Moamalat Financial Services Company, and several directors of relevant departments in Central Bank on Wednesday, 21 May 2025.

The meeting addressed a range of key issues, foremost among them the readiness of commercial banks to implement the upcoming cash distribution plan, especially in light of the exceptional circumstances the country is currently facing discussions also covered ways to enhance and develop electronic payment services, with the aim of improving the quality of banking services and expanding financial inclusion.

The Governor emphasized the importance of unifying efforts and strengthening coordination to ensure the continuity of financial services provided to citizens, thereby reinforcing trust in the banking sector. He urged banks to intensify efforts to upgrade their technological and digital infrastructure, particularly in the fields of electronic payments and instant payment services, given their critical role in improving operational efficiency and broadening the reach of banking services.

During the meeting, it was agreed to reduce the commission fee on electronic payment services to 0.5% for the time being. Additionally, banks were encouraged to extend working hours to better meet customer needs for cash withdrawals ahead of Eid al-Adha. Banks were also urged to enable interbank transactions through ATMs (Off-us transactions).

The Governor and his Deputy concluded the meeting by underscoring the necessity of full compliance with the regulations and directives issued by the CBL, in order to promote discipline, transparency, and the continued stability and development of the banking sector.

As part of the meeting, participants reviewed recent electronic payment statistics, which reflected significant advancements and record-breaking growth across various indicators.