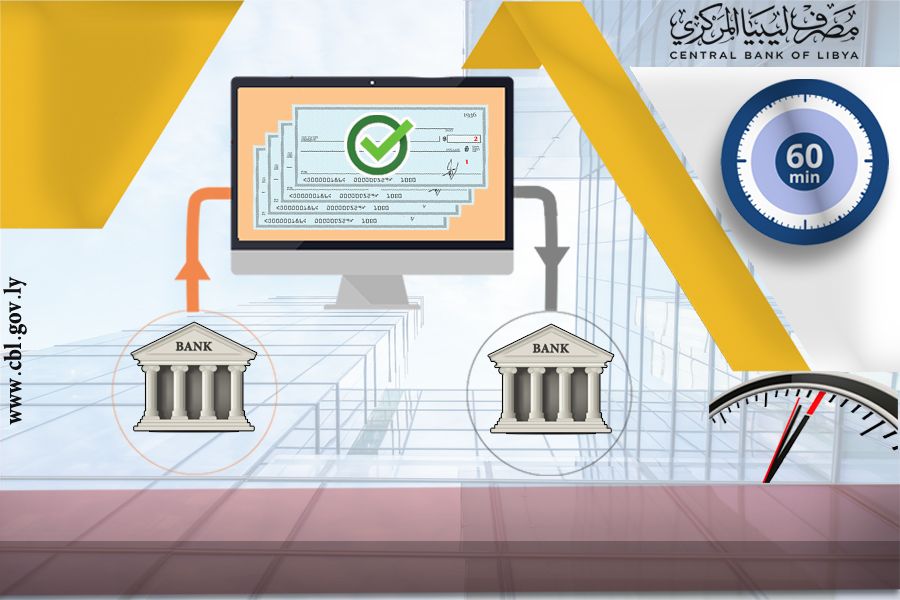

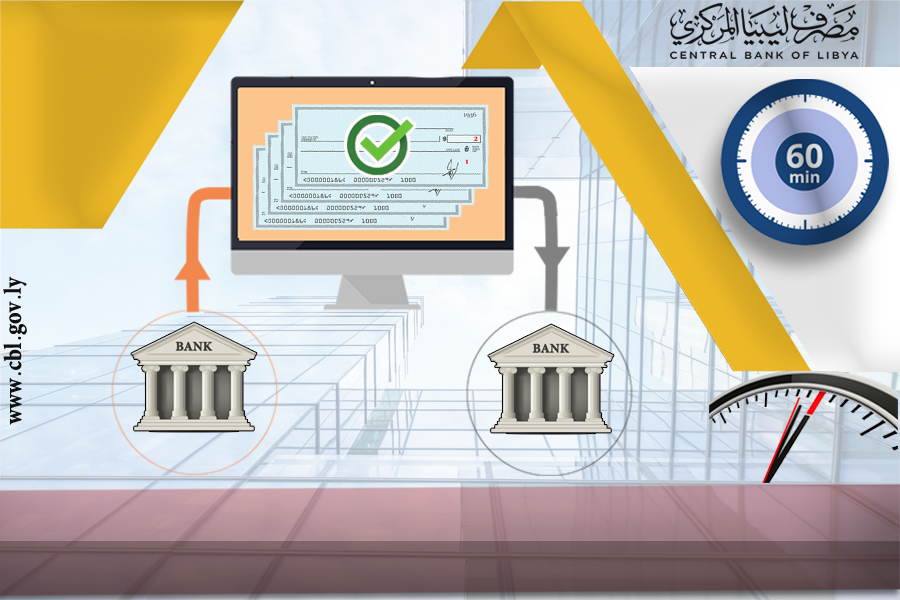

The Central Bank of Libya started working electronically on the new Automated Clearing House of Instruments system: The instruments will be registered in the Automated Clearing House system at the same moment or at maximum the same day for all branches connected to the system.

| News

The Central Bank of Libya began working on the developed system of Automated Clearing House of Instruments on Monday morning the 24th of October 2016 as part of the plan put to develop the national payment system. This developed system allows the instrument to be registered in an hour or at maximum during the same day, in all commercial banks and their branches which are connected to the system provided by (Progress Soft Company).

This project was launched in September 2015 and started effectively working in 2016. This project faced many difficulties due to the current circumstances in the country. The Central Bank of Libya and a number of commercial banks in Libya selected the system of Automated Clearing House of Instruments to combine with their central banking systems in which facilitates the Automated clearing house cycle, that is faster, more secure, automated and efficient.

The Libyan Banks and their branches will benefit from many advantages by using this system, the most important advantage of operational risk will be reduced and the process of exchanging instruments will be more secure by allowing follow-up and tracking of the exchange of instruments between the banks participating in the system. In addition this system applies the latest security policies, saving time and effort by centralizing the processing between banks connected to the system.

Also, this electronic system provides reports and statistics to facilitate the review and audit of all operations of bank branches by the Central Bank of Libya. The implementation of the electronic clearing system of instruments will help the banks in Libya to finalize the role of clearing instruments faster and contribute to the acceleration of the cash in circulation and positively affect the national gross of Libya.

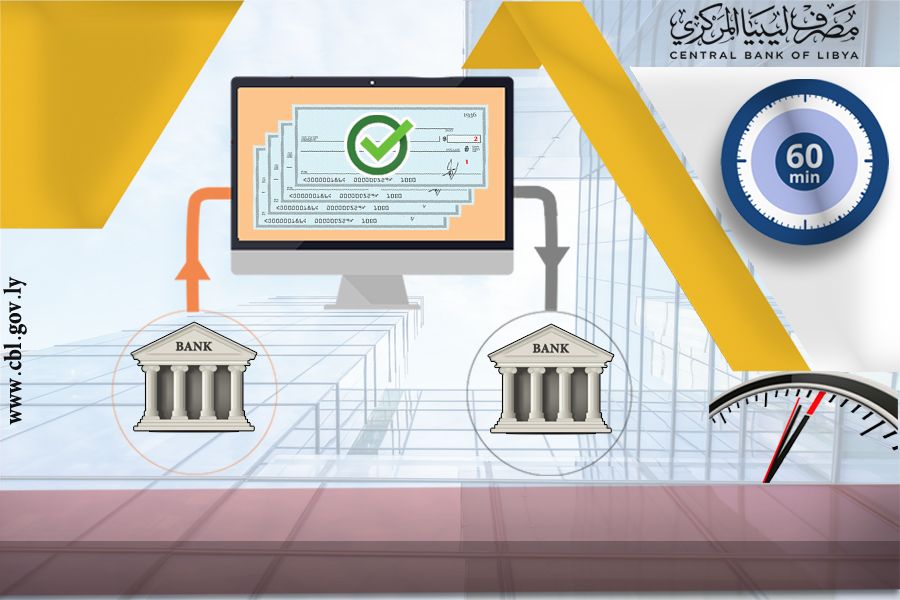

The Central Bank of Libya began working on the developed system of Automated Clearing House of Instruments on Monday morning the 24th of October 2016 as part of the plan put to develop the national payment system. This developed system allows the instrument to be registered in an hour or at maximum during the same day, in all commercial banks and their branches which are connected to the system provided by (Progress Soft Company).

This project was launched in September 2015 and started effectively working in 2016. This project faced many difficulties due to the current circumstances in the country. The Central Bank of Libya and a number of commercial banks in Libya selected the system of Automated Clearing House of Instruments to combine with their central banking systems in which facilitates the Automated clearing house cycle, that is faster, more secure, automated and efficient.

The Libyan Banks and their branches will benefit from many advantages by using this system, the most important advantage of operational risk will be reduced and the process of exchanging instruments will be more secure by allowing follow-up and tracking of the exchange of instruments between the banks participating in the system. In addition this system applies the latest security policies, saving time and effort by centralizing the processing between banks connected to the system.

Also, this electronic system provides reports and statistics to facilitate the review and audit of all operations of bank branches by the Central Bank of Libya. The implementation of the electronic clearing system of instruments will help the banks in Libya to finalize the role of clearing instruments faster and contribute to the acceleration of the cash in circulation and positively affect the national gross of Libya.