The closing day of the workshop of systems and methods on combating money laundering and terrorism financing

| News

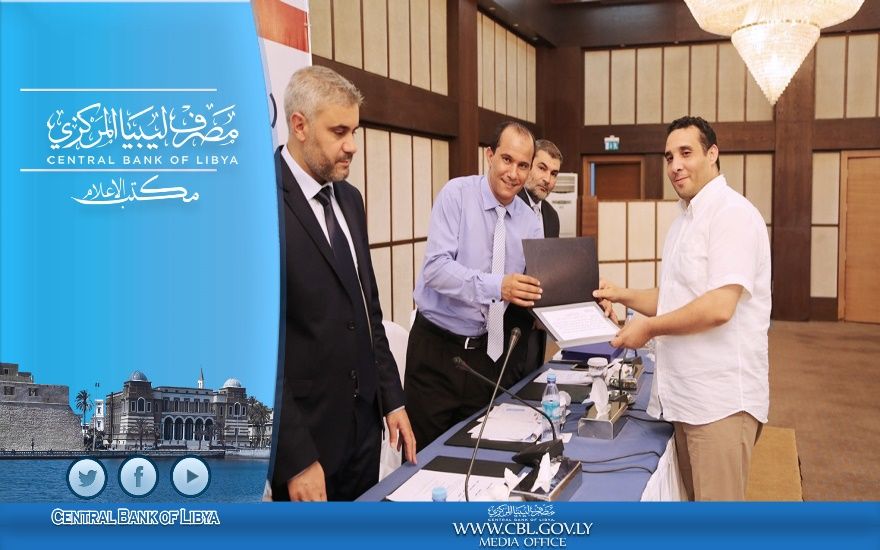

On Wednesday the 8th of September 2016 at the Radisson Blue Hotel was the closing day of the workshop of systems and methods on combating money laundering and terrorism financing. The workshop was under the supervision of the Financial Information Unit of the Central Bank of Libya in Tripoli with participation from the Prosecutor's Office and prominent specialized professors in the field of money laundering and auditing.

Dr. Sobhi Misbah, Head of the main Financial Information Unit of the Central Bank of Libya in Tripoli, stated to the Media Office of the Central Bank of Libya the following:

“this workshop has two aims, one is direct and the other aim is strategic:

The direct aim is to define the crime of money laundering and terrorism financing, identify the sectors in these crimes, the punitive measures the law has established, the disclosure procedures by the concerned institutions and the dangerous repercussions on the national economy. Also, to find a mechanism for efficient coordination among the relevant actors that are responsible to initiate the law. We could say that we reached this goal with coordination between the Financial Information Unit of the Central Bank of Libya and the Prosecutor's Office.

For the strategic aim, we stressed the importance of the mutual evaluation that Libya will be subjected to in the middle of 2017. We have presented during the workshop a presentation that clarifies the importance, necessity, requirements, and the repercussions or the results of this evaluation concerning the identified institutions.

In conclusion the workshop concluded the following recommendations:

1 – Form a committee with members from the Financial Information Unit, the Prosecutor's Office, other authorities responsible for enforcing the law of money laundering and including professors specialized in studying the field of money laundering and terrorism financing before being presented to the legislature. Until the adoption of the law, we can rely on the resolutions and the publications issued by the Governor of the Central Bank of Libya and implement the international recommendations regarding money laundering and terrorism financing policies.

2 -Develop public policies to target money laundering and terrorism financing according to international standards and the transmission to operational procedures with effective supervision.

3 -Arrange meetings and workshops that include general managers of financial institutions and managers of the supervisory authorities to achieve the knowledge and effectiveness for the mutual evaluation.

4- Enhance the communication between the Financial Information Unit, the Prosecutor's Office and all the concerned authorities in enforcing international legislation on money laundering and terrorism financing.

5- Focus on specialized training for money laundering and terrorism financing for all employees, observers, information sub units and the main Financial Information Unit.

6- The necessity to put standards for managers and the employees of the sub-units of the commercial banks besides the main Financial Information Unit.

7 – The Customs representative recommended two very important things.

First: The need to incorporate statistical figures in the bill of lading.

Second: To complete the access of custom disclosure statements and recommended that there should be an active role for commercial banks to not accept any customs declarations for the items that are not accepted by the General Administration of Customs.”